China Emerging Market Focus

INTRODUCTION

China is a global powerhouse, with a rising domestic sports market and the eyes of the international sports industry trained upon it and its 1.37 billion citizens.

Domestic leagues such as the Chinese Basketball Association (CBA) and Chinese Super League are professionalizing, major events such as the 2022 Winter Olympics are being successfully bid for, and international teams, leagues and events are busy laying foundations in the country.

Much of this stirring interest in sport stems from the Chinese government’s plan to build a CNY5 trillion (US$813 billion) sports industry by 2025, a strategy covering everything from improved fitness to encouraging foreign investment, grassroots sport to elite performance.

Football, for example, is now part of the schools system in the country, and, as the following pages show, the push towards more active life- styles is beginning to have a positive impact. A host of new facilities and initiatives are underway to help increase participants and create fans.

Technology is central to the growth opportunity for both domestic and international rights holders and brands. China’s media landscape is transforming. Indeed, it is leading the way in terms of OTT technology and the integration of data, with several online media platforms competing for premium international sports rights to build subscriber and audience bases.

But even in a market where such huge opportunities for growth beckon, the fundamentals are still vital: accurate measurement of the value being created through sponsorship and investment by brands, in all its forms, is essential, as is a forensic understanding of the market -its rising middle class, the way the country is structured and the wide divergence between its cities.

The following pages offer a mere snapshot of the current Chinese sporting fanscape and landscape; we’d be delighted to speak to you in greater detail about your strategy for China and how Nielsen Sports’suite of solutions can help.

This is the latest in a series of whitepapers produced by Nielsen Sports in collaboration with Leaders.

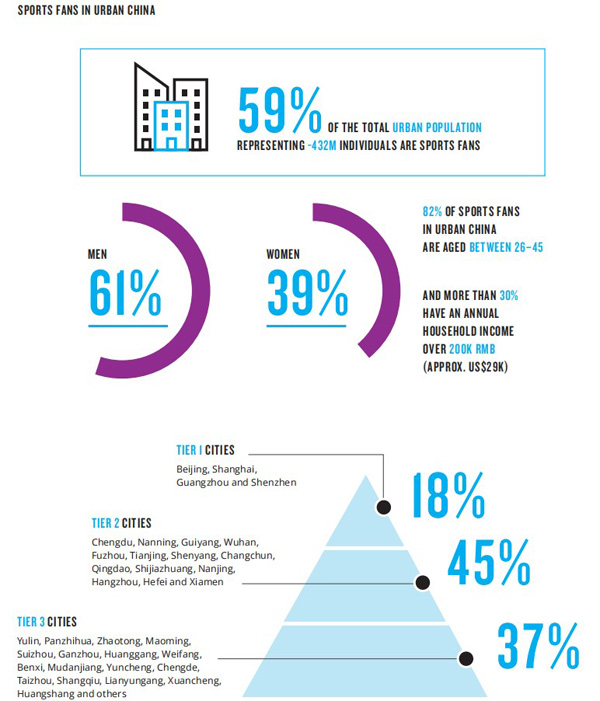

MORE THAN HALF OF THE URBAN CHINESE POPULATION ARE SPORTS FANS…

Source: Nielsen Sports SponsorLink China, May 2017

1,100 respondents; online survey covering Tier 1, Tier 2 and Tier 3 cities in China - a nationally representative sample. Results weighted using Stats China data to project accurately to the the 18+ population.

SPORTS INTEREST

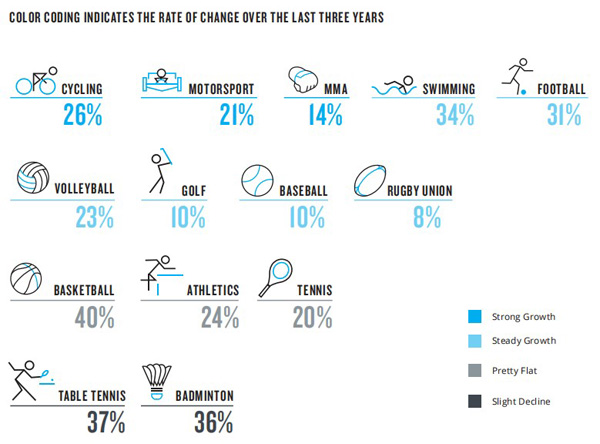

Interest in football has been growing steadily over the last 3 years, and now stands at 31% of the urban population aged 16–59. Basketball is the country’s most popular sport – the Chinese Basketball Association, the top-tier basketball league in China, was founded in 1995, while the NBA has played games in the country for over a decade – ahead of traditional favorites, table tennis and badminton.

Sports such as cycling have grown in popularity recently, perhaps a result of the increased national investment in a number of Olympic sports in the build-up to Beijing’s hosting of the 2008 Olympic Games–and more recently the debut of events like the Tour de France China Criterium. Motorsport and mixed martial arts are also growing strongly.

CURRENT CHINESE INTEREST LEVELS IN SELECTED SPORTS (%)

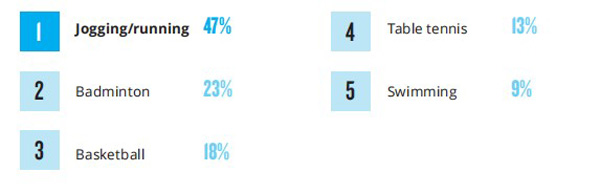

RISE OF AN ACTIVE AUDIENCE

A third (32%) of China’s urban population actively participate in sport and there appears to be an increasing enthusiasm for general health and well-being. Of those people, nearly half (47%) jog or run – up from 31% three years ago. Nearly a quarter of active sports participants (23%) play badminton, while 18% play basketball.

Physical ftness and health were identifed as key pillars in the Chinese government’s much-publicized 2014 plan to create a CNY5 trillion (US$813 billion) sports industry by 2025. One stated target was to encourage over 500 million people in the country to exercise. This has driven major investment in sporting facilities and prompted domestic and international rights holders to engage in long-term strategic partnerships with Chinese frms, in a bid to capture the hearts and minds of the Chinese population.

· Earlier this year FIFA and Wanda Group signed a partnership covering the next four editions of the FIFA World Cup. According to the announcement, ‘Wanda Group will engage in numerous initiatives, with a strong focus towards grassroots football development in China PR and the Asian region.’

· A ‘ground-breaking agreement’ between Wanda Group and the Union Cycliste Internationale (UCI) was announced in December 2016, including the creation of mass participation elements around two new elite events in the country. Wanda is also investing in a cycling centre in China, providing training facilities for young athletes. According to the UCI, bike ownership in China has reached 600 million, while the country boasts 20,000 cycling clubs and 15,000 bike stores. Wanda has also struck long-term commercial agreements with FIBA, world basketball’s governing body, and the Badminton World Federation.

· The International Ski Federation (FIS) announced in June a new cooperation agreement with Alibaba Sports Group, with the aim of creating 30 million Chinese snow sport participants ahead of the 2022 Olympic Winter Games in Beijing. Alisports will help to develop and deliver the federation’s ‘Get into Snow Sports – China’ initiative.

Q AND A

THE LEADERS INTERVIEW – WORLD RUGBY CEO, BRETT GOSPER

World Rugby has attracted US$100 million investment from Alisports over 10 years to support the growth of rugby at all levels in China. As well as helping to establish China’s first professional leagues for men and women, Alisports will help World Rugby’s mass participation programme ‘Get into Rugby’, which will roll-out in 10,000 universities and schools in 20 of China’s 23 provinces. As World Rugby Chief Executive Brett Gosper explains in this interview with Leaders, the aim is to attract and retain one million new players over the next five years.

How would you describe the current level of rugby in China?

Gosper ▸ Rugby is at the foot of the mountain in China. There are probably between 75,000 and 100,000 participants in the country. The MOU with Alisports is a strong commitment and with it come some very big metrics. We were looking to get a million players by ten years, and they corrected that and said we should be able to do that within fve years. That’s the goal, and the knock-on of that is the geometric equivalent in growth of referees, coaches, medics etc. Obviously there are communication and cultural issues. We’re also trying to put some major competitions into China and there are infrastructure issues – size of stadia, security requirements in terms of policing, the general non-culture of spectator sports means that you have to be pretty realistic in terms of the crowds you expect; you think China is a lot of people therefore you’ll fll a stadium easily but that’s not the case at all. The fact that we’re an Olympic sport helps hugely. The small ball sports roll up into the ultimate decision makers at the

National Olympic Committee. That connection is important – particularly important in getting rugby into schools.

What is the Alisports agreement doing for you?

Gosper ▸ The deal with Alisports is both money provided to develop in exchange for IP that we would provide, and ecommerce in the way of a World Rugby shop. There are some exchanges of assets between the organizations. But we believe the government is pushing quite hard for some of the bigger private companies to get involved in driving sport, both as a health beneft, but also, in rugby terms, they like the values that are conveyed by and pushed by the sport of rugby throughout the world. So their goal in the nearest future is to get into the HSBC Sevens World Series, but they harbor some ambition also to host a Rugby World Cup at some point in the future that we can’t defne. They’re quite bullish. The deal is about high visibility. The reach of Alibaba as a platform is interesting for us. It doesn’t preclude us at this point from using some other linear terrestrial channels in China to gain that exposure and they see the benefts of that. There’ll be some exclusive content but also non-exclusive.

Is there a model you’re following for growing the game in China?

Gosper ▸ The accessibility and visibility of football makes it a category of its own; and then to fnd sports that are very compatible, on governance and marketing, it’s very hard to extrapolate the experiences of other sports, although we follow them pretty closely to see if there’s any learnings at all. I think we’re more likely to gain from experiences we’ve had in sizeable markets that have grown fast in recent years. I guess the United States, although incredibly diferent to China, does provide some lessons in terms of our mass participation programme, which is Get In To Rugby; that’s your big uptick

programme of providing minimal equipment and laws and getting people to touch the ball and providing the opportunity to touch the sport. That gives us a good idea of what the uptake could be. But you’ve also got to have that inspirational leap: you’ve got to have professional codes in sevens and fifteens; the profle of the Olympic Games means you’ve got to very quickly have a competitive Chinese team, whether it be men or women, and sevens rugby lends itself to a very quick implementation of a credible, viable competitive programme.

What are the major challenges of developing a sport in China?

Gosper ▸ From the conversations with Alisports to the MOU was very quick. But because you’re not dealing with a country that has a very strong, broad sporting culture, not everyone you deal with has a good sense of what we mean when we’re talking about events, what we mean when we’re talking about the development of the sport; we take things for granted in the western world because sport has been so central to what’s done in schools, people’s leisure time etc. I think we also underestimate the breadth of people involved in decision-making. It tends to be wider, more channels, more people to bring along with you than most western nations where that authority has been delegated to fewer people.

THE OUTLOOK

CHINA AND SPORT

· China represents an enormous growth opportunity but the market continues to evolve, so the most successful rights holders and brands - either domestic or international – in the country will be those that can be agile and adapt to changing circumstances.

· A deep understanding of China’s approach to sports and its approach to business is fundamental to success – and that understanding must go right up to state level.

· In the short-term, the focus will continue to be primarily on international rights holders entering the Chinese market – staging events, holding training camps, going on tours, opening commercial ofces - but in the longer-term, as they gather commercial momentum, expect China-based rights holders – leagues and teams – to begin to look outwards.

· As with every market, a detailed understanding of fan behavior and consumer habits is critical to unlocking more value for rights holders, brands and all other stakeholders.

©2008-2019 CHINA SPORT SHOW, All Rights Reserved(京ICP备05083596号-2)