What Gen Z wants for Christmas

Given its size and youth, Gen Z might well be the most coveted generation by retailers right now, now, regardless of how young they are and how much money they have to spend. Like a snow leopard hiding out in the Himalayan mountains, the generation is both elusive and searched for relentlessly — and for good reason.

Baby boomers are certainly still a key demographic for retailers, but Generation Z offers something perhaps more valuable than disposable income: a glimpse of what their future holds. It's all well and good to appeal to Baby boomers, Gen Xers and millennials, but at the end of the day, retailers want that golden stamp of approval that when Gen Z comes along, they'll still be able to stay in the black.

The demographic's preferences have the potential to impact not only what shopping will look like (mobile, social, experiential, etc.), but also merchandising, the speed of supply chains and just about every aspect of retail that's worth considering. While reports have varied widely on how much spending the group actually commands, a report by Barkleyestimates it's somewhere around $143 billion, based on estimates of $43 billion for Gen Zs relying on their allowance and $100 billion for those earning additional income.

Another study by CPC Strategy calls out Gen Z as a group that's actually planning to spend more this season (at least 21% of them are), but the same study notes that 66% of Gen Z is limited to a budget of less than $250.

"Getting it right, even though this kid might be 15 — it still matters quite a bit."

Kelly Davis-Felner

Senior Director of Demand and Retention at Bazaarvoice

However much they have the ability to spend, it's not really about the money, according to Kelly Davis-Felner, senior director of demand and retention at Bazaarvoice. During the holidays, and beyond, retailers should be thinking long-term about the trends they're seeing in Gen Z — and trying to make a good impression.

"As you sort of think about them matriculating over the next five years, brands and retailers are building foundational relationships right now that when you think about customer lifetime value will pay dividends well into the future," Davis-Felner told Retail Dive in an interview. "So getting it right, even though this kid might be 15 — it still matters quite a bit."

Kids these days just want experiential retail

Of all the things that define Gen Z (albeit at a very nascent stage), a love of experiences is near the top of the list. All of the store concepts that keep cropping up in SoHo (and other parts of New York) are ostensibly geared toward the draw that both millennials and Gen Zers feel toward having something more than just a transaction with their favorite brands. That's manifested itself in meditation studios, in-store basketball courts and even private listening rooms — just about anything that says "experiential," retailers have tried.

When it comes to the holidays, though, retailers don't have to have fancy store concepts in order to capitalize on Gen Z's love of experience. According to data from Bazaarvoice that was emailed to Retail Dive, buyers in the 18-29 demographic, which includes both younger millennials and some older Gen Zs, are increasingly interested in gifting experiences for the holidays. While nearly all (90%) still plan on giving physical gifts, a significant segment (30%) plans to give experiential gifts this year, with crafting (47%), foodie (45%), travel (41%) and romantic gifts (35%) ranking highest for the demographic.

That's a lot of interest retailers have the potential to cash in on, and not just by offering cooking classes, Davis-Felner said.

"They want things quick, they want it readily available, they don't want to have to go out of their way — because they haven't had to do that."

Tom McGee

President of ICSC

"What experiential gifting tells you is that younger consumers, and Gen Z in particular — they care about things that connect them to other people," she said. "It is telling that is what's driving people to the store. They're looking for something more than the transactional walk-in, pick up the sweater and walk back out. They're looking for something that is going to resonate with them, it's going to feel authentic, it'll make them feel connected to that brand or retailer. You may not have an experience to sell in the literal sense of 'come to my painting class,' but you are still very much selling an experience."

Get marketing news like this in your inbox daily. Subscribe to Marketing Dive:

Email:SIGN UP

By signing up you agree to our privacy policy. You can opt out anytime.

In stores especially, Davis-Felner recommends that retailers try incorporating more active elements like product trials and readily available ways for customers to engage with the brand on social, naming Sephora as a good example of a retailer with an active in-store experience and a diverse group of store associates that appeals to the group.

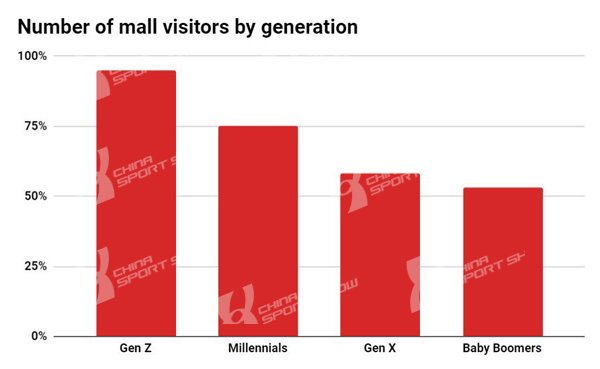

That's particularly important as much of the generation's shopping still takes place in stores. According to a study by the International Council of Shopping Centers emailed to Retail Dive, 95% of Gen Zs made a trip to a shopping mall within a three-month period and 75% say that shopping in physical stores is a better experience than shopping online.

Over a three-month period, 95% of Gen Zs had visited a shopping mall. Credit: Cara Salpini for Retail Dive; Source: ICSC

Tom McGee, president of ICSC, says that's because to Gen Z, the mall represents more than just shopping — it's a space of entertainment more broadly and a safe environment for them to spend some time hanging out with their friends. He notes that in key categories, including apparel and electronics, Gen Zers make most of their purchases in stores, making strong merchandising key.

"They're used to having a lot of information at their fingertips. They're used to things being visually appealing. They're not used to having to search for things in depth," McGee told Retail Dive in an interview. "Information's very accessible, so products have to be very accessible. So the way you merchandise your store, I think, has to play to the way that this group has grown up and the way they process information. They want things quick, they want it readily available, they don't want to have to go out of their way — because they haven't had to do that."

Having technology in stores — even if it just means being able to use mobile to pay for products — is part of that convenience factor, though McGee points out that technology is not the only way for stores to be deemed "experiential." Indeed, off-price retailers like T.J. Maxx and Ross, which have been on a tear for a while now, are experiential in their own right by fostering the type of treasure hunt atmosphere that lets customers feel like they can explore. McGee points to the "ability to find that hidden gem" as another big appeal for Gen Z shoppers.

Christmas is on Twitter, why aren't you?

No one seems to know exactly where Gen Z begins (some record data for the demographic up to age 24 and others only record for those currently under 20), but everyone seems to agree that whoever Gen Z is, they love social media. While retailers might not care about how many selfies they post to Instagram every day, social platforms are starting to impact the generation's shopping habits, making it worth a retailer's while to post, pin, like and tweet with followers.

ICSC found that over four-fifths of Gen Zs use mobile devices while shopping in stores, whether it's to keep in touch with friends and family or to compare prices and look for discounts. More significantly, nearly 80% of the group said they've purchased something in a store as a direct result of seeing it on social media. Retailers should not only be thinking about how to integrate mobile more deeply into stores, but also how best to drive interaction on social and make sure that their efforts aren't being lost in a sea of other brand posts.

"These are very, very savvy consumers and they will sniff any kind of fakeness at 20 paces."

Kelly Davis-Felner

Senior Director of Demand and Retention at Bazaarvoice

"You hear a lot about Gen Z being very values-driven and I think — to the extent that you can kind of bring that into your brand narrative and therefore have that extend out into what you're doing in digital — I think that resonates particularly well with them with the caveat that it has to feel authentic," Davis-Felner said, mentioning REI's #OptOutside program as an example that is both truthful and on-brand. "These are very, very savvy consumers and they will sniff any kind of fakeness at 20 paces."

Having something to stand for has become increasingly popular for retailers, especially with outdoor retailers such as Patagonia that often have environmental causes tied to their brand message. But, Davis-Felner warns against retailers trying to tell Gen Z what to do and instead encourages trying to engage them in conversations around a certain topic.

While buying online has been popular among young consumers for some time now, 43% of shoppers aged 18-29 plan to spend more time online this holiday season, according to Bazaarvoice. The integration of social media could not only change the way that customers transact, but also the tenants of in-store merchandising. That's mainly due to the fact that Gen Zs frequently post their outfits to social media and don't want to be seen repeating them, according to McGee, making it imperative for the generation to find new clothing at affordable price points.

ICSC found that for apparel (and other key categories), physical stores were preferred. Credit: Cara Salpini for Retail Dive; Source: ICSC

"It raises the ante of the integration of the physical and digital environments and I think it probably creates an environment where you need to have a very frequent rotation of products — kind of constantly refreshing your inventory because of just the omnipresent nature of sharing what's happening in your life and what you're wearing," McGee said.

In addition to the potential Gen Z has for changing how frequently retailers rotate their product, their mobile habits also raise the bar for retailers to have a consistent presence across all channels, including mobile. According to Davis-Felner, customers should not only be able to check out with their phones, but also have their online profiles and preferences reflected in the in-store experience.

"They don't really think of the world as this online-offline binary. It's all one experience," Davis-Felner said. "I think that is why you're starting to see retailers integrate someone's digital identity with the in-store experience … it is all online, even when you're standing in the store and the store is as much a connected experience as someone actually being on your site to conduct a shopping transaction."

The old ways are not yet lost

We talk a lot about what's different with Gen Z, but not a lot about what's the same. Yet during the holidays, there are at least a few points where Gen Z aligns with the rest of the population, one of which is Black Friday. The shopping holiday gets plenty of coverage every year, with some saying it's fading out of existence while others claim it's becoming more popular. Either way, it clearly hasn't gone anywhere yet — and Gen Z is helping ensure it doesn't.

The holiday study from Bazaarvoice found that beyond just looking for discounts, younger shoppers also go shopping on Black Friday and other sales days because it's a tradition with their families and friends. In shoppers age 18-29, nearly a third (31%) listed shopping on sales days as a family tradition — stats which fall to 23% and 19% respectively for Gen X and baby boomers.

Younger shoppers are more likely to go Black Friday shopping because it's a family tradition.Credit: Cara Salpini for Retail Dive; Source: Bazaarvoice

"There's all this crazy news coverage of people breaking down the doors and all that stuff, but the things that we found in our research are that the other things that resonate are things like: 'I like it when there's festive music,' 'I enjoy looking at the decorations,' 'I like it when I can have an experience when I shop,'" Davis-Felner said, mentioning popular holiday activities like Santa visits and ice skating.

Gen Zers also aren't immune to impulsive purchases and self-gifting during the holidays. More than half (51%) of all demographics have kept a gift intended for someone else, according to Bazaarvoice, and that number is even higher among millennials (64%). They've also got more time on their hands to go shopping, as most of them don't have full time jobs or families, and they've got their parents' wallets to foot the bill for them.

To that end, a lot of the tenets that apply to other generations also apply to Gen Zs. Good pricing is part of the equation, especially with how easy it is to price compare, but customer service could also be a big factor, according to McGee.

"These generally are younger shoppers, so to the extent that they're being treated with respect and courtesy and not being dismissed because of their youth I think is really important, and I think that creates a lot of loyalty in that retailer over time," McGee said. "We can never misestimate the importance of customer service, having the right product at the right price — that's tried and true across all demographics."

©2008-2026 CHINA SPORT SHOW, All Rights Reserved(京ICP备05083596号-2)